Part of the regular cost of running your typical North American home are receiving the dreaded utility bills. They sometimes offer VERY unpleasant surprises when the bill comes in far higher than expected.

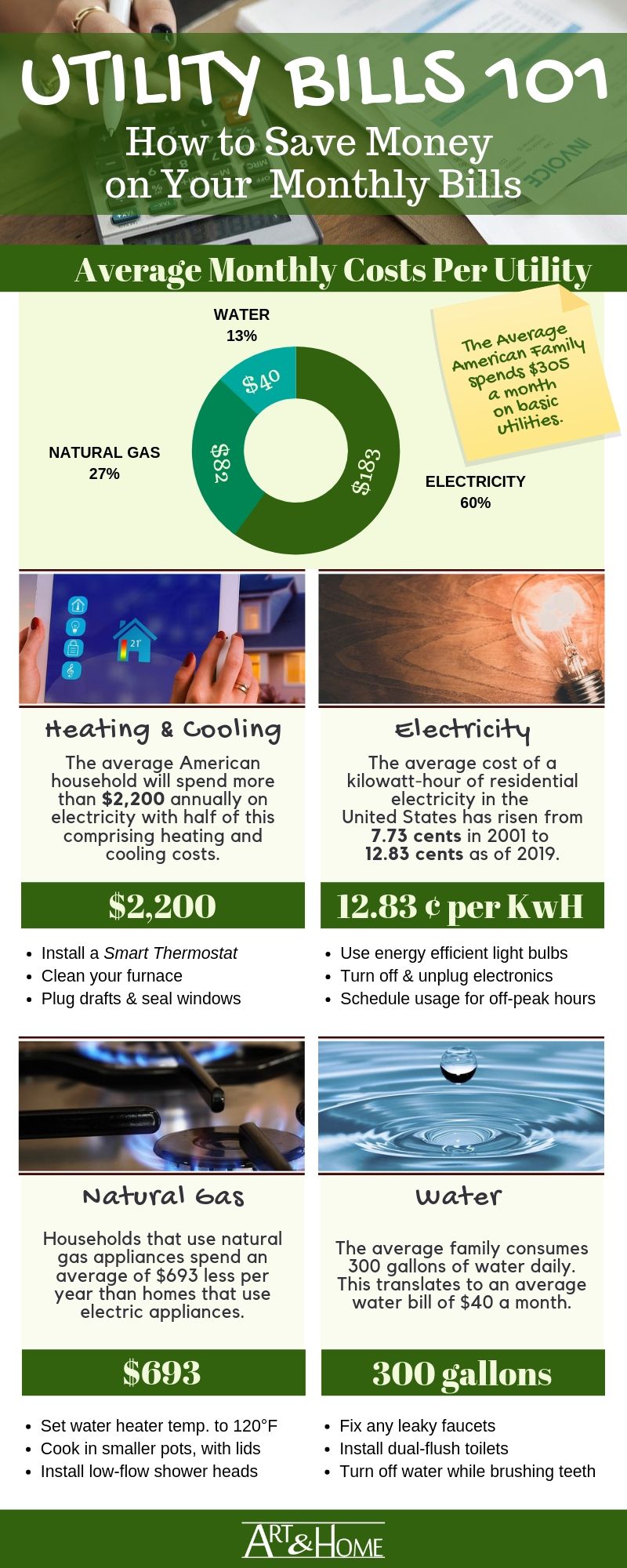

The Average American Family spends $305 a month on basic utilities.

Plus, there are some things that can cause unusual spikes in your typical utility bills include:

- Unusual spikes in temperature | Extreme or prolonged cold or hot weather can increase your heating & cooling costs

- Dry spells | When it’s not raining, homeowners tend to run their sprinklers more often

- Spring Cleaning | Catching up on cleaning, laundry, and other household chores can cause a spike in electricity use

- Guests (Welcome or otherwise) | Additional residents will increase hot water & electricity usage

Beyond the unusual peaks and valleys, you should budget for a minimum of $200 with an average of $305 on utilities per month. That’s a lot of cash – in fact, it’s about 7% of the average American income – so it’s important to understand how the costs are incurred and what you can do to save money on your monthly utility bills.

And – as a bonus for the planet as a whole – reducing your utility usage is not only friendly on your wallet, it’s also environmentally friendly too!

Let’s take a closer look at the average costs of different core utility bills and how to keep your costs low.

1. Heating and Cooling

The typical American household will spend more than $2,200 annually on energy with half of this comprising heating and cooling costs. Of course, given the size and climatic diversity of the United States, the actual costs will vary primarily based on location but also the size and design of the home. A bigger home means larger heating and cooling expenses.

There are several ways you can lower your heating and cooling costs but perhaps the most important is to install a smart thermostat. Smart thermostats learn and adapt to your preferences and automatically adjust their settings depending on whether there’s someone or no one in a home or room. Replacing a conventional thermostat with a smart one can cut your costs by 10-15%.

2. Electricity

The average cost of a kilowatt-hour of residential electricity in the United States has risen from 7.73 cents in 2001 to 12.90 cents in 2017 but has dipped slightly to 12.83 cents as of 2019. How close you are to that average will depend greatly on where you live, with New Mexico being one of the the cheapest places to buy electricity and South Carolina being the most expensive (e.g. take a look at Texas Electricity Plans: electricity plans).

Your power bill will also depend on what electronics and appliances you use. For example, your old refrigerator will cost an average of $16.50 per month, whereas your Digital Video Recorder will only cost you $3.17 per month.

To contain your electricity costs, start by switching off and unplugging your appliances and gadgets when they aren’t in use.

Replace your appliances with more energy-efficient alternatives. An Energy Star rated refrigerator can save as much as 77% off the cost of running your fridge. At an average savings of about $12.70/month, that new fridge will – effectively – pay for itself in time.

Upgrading your light fixtures is another way to save money on your utility bills. Replacing your incandescent light bulbs with more efficient options can save you enough to buy one or two fancy Starbuck’s coffees while unplugging appliances when they are not in use can cut your power bills by $100 or more.

Read More Electricity Saving Tips >>

3. Natural Gas

Natural gas is what nearly nearly 66 million use to heat their homes, but reading a gas bill can sometimes feel a bit like going through a nuclear physics thesis.

Natural gas can also be used for common household appliances in order to help reduce your utility bills. In fact, households that use natural gas appliances for heating, water heating, cooking, and drying clothes spend an average of $693 less per year than homes that use electric appliances.

Nevertheless, there are just a couple of things you need to understand.

The BTU (British Thermal Unit) which is a unit of energy. In 2016, the average household consumed more than 60 million BTUs.

The average cost for Natural Gas can range based on distance from pipeline sources, so states such as Florida and Hawaii pay the most for natural gas while North Dakota and Montana pay the least.

However, those lower-cost states also tend to have higher consumption because of their reliance on Natural Gas for home heating throughout cold, cold winters.

Beyond consumption and the price of the gas itself, your bill may also contain delivery fees and taxes, which can vary greatly from provider to provider.

One of they key ways to save money on natural gas are called out in the Heating cost savings noted above, but are several other key areas where you can save on Natural Gas costs.

Because the two biggest uses for natural gas are home heating and water heating, in most cases, saving on your seating and reducing your water consumption will automatically lead to savings in your natural gas expenses.

However, there are a few other areas where you can add additional savings when it comes to natural gas particularly for natural gas appliances, such as dryers, kitchen stoves, and natural gas water heaters.

The default setting for most hot water heaters is

140° F . By setting your water heater temperature no higher than 120°F ( 49°C ), you could save 10% on your water heating costs.

Taking shorter showers and using low-flow shower heads will not only help you save water (see more on that subject below), but will save on water heating costs.

Lastly, when cooking on a Natural Gas stove, use the right-size pan and use a lid so your food cooks faster. Plus, using a microwave or toaster oven to reheat smaller dishes will save money versus using the full-size stove for smaller jobs.

4. Water

The average family consumes 300 gallons of water daily. This translates to about $50 a month in water bills. Like electricity, the unit cost of water has been steadily on the rise, and has gone up by more than 40% between 2010 and 2015).

The secret to lowering your water bill is simply reducing intake. ‘

So when you are brushing your teeth, don’t leave the faucet running. Turn it on only when you are actually fetching water.

Fix any leaky toilets or taps. A slow “running” toilet can accumulate over $400 in water usage in a single month. I know this from VERY personal experience!

You can also automate water saving by installing low-flow showers and faucet aerators. These can reduce discharge by more than half.

Plus, water your lawn wisely.

Read More Eco Friendly Water Saving Tips >>

4. TV, Phone & WiFi

Some people consider their phone, cable TV and WiFi as basic necessities, some see these as luxuries. Whichever way you view these utility bills, the importance is to have the services you need at a cost you can afford.

The first step is to determine what services you need in order to make sure the plans are right-sized for your life. Do you still need both a home phone AND a mobile phone? More and more families are doing away with the home phone, but that might not be the right choice for you.

If you’re not watching those premium channels since Game of Thrones ended, cut back on your cable package.

Unused data is as wasteful as leaving your front door open in the middle of winter. If you have WiFi, use it whenever you can to reduce your reliance on Mobile data. After a few months, check your usage history and downgrade your package to cover only what you need.

Don’t let yourself fall into default billing cycles. If your contract is up for renewal, speak with your service company about what new packages, deals, or incentives may be available to you.

Balancing Your Bills

Utilities are essential for a good quality of life. But by applying some of these tips, you can help keep your utility expenses from spiraling out of control.